Aquisitions and Exclusivity: The New Monopolies

February 14, 2022

In the modern technological age, the rise of FAANG (Facebook, Apple, Amazon, Netflix, and Google) and other massive companies like Disney, Sony, and Microsoft provides a window into the game of modern monopolies. For many years, these companies have grown at unprecedented rates with many now reaching market caps in the trillions of dollars, and they have largely avoided legal repercussions from their ubiquitous usage. However, recent bursts of acquisitions and the subsequent fallout may indicate more serious trust concerns in the future.

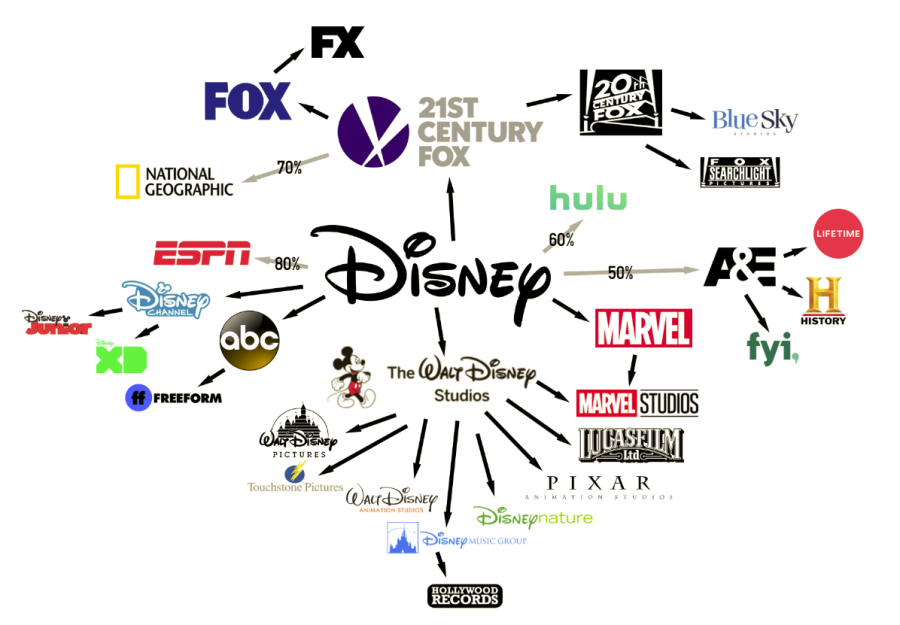

In 2012, Facebook, now Meta, purchased Instagram for $1 billion, and Disney acquired Lucasfilm (Star Wars) for over $4 billion. Later in 2016 Time Warner and AT&T merged for nearly $85 billion, followed by Disney buying another giant, 20th Century Fox, for $85 billion in 2019. The new decade has brought even more consolidation with the notable acquisition of Activision Blizzard by Microsoft for $68 billion, and Sony’s buy of Bungie for over $3 billion shortly after. Countless other deals, mergers, and billions of dollars can easily confuse even the most financially savvy consumers, but the crux of all of these purchases are the pseudo-monopolies that are beginning to form. Mr. Taylor, an economics teacher at Coronado, adds that “[They’re] looking at that real-estate … they seem to have a battle going on, and in terms of the regulation with that, I’m sure [the government] is gonna look at it, but it seems like the ground is shifting.”

While many of these acquisitions have yet to directly affect consumers, the omens are already there. Tensions between Microsoft and Sony exclusives, limitations of content to specific services, and the ever present threat of increased prices all loom overhead. The real question on many minds: what is being done? Mr. Taylor explains simply why reform may come too late: “antitrust laws are always behind the curve, regulation is always behind the curve. By the time that starts to come on their radar it will be a mute point.” Many of these mega-corporations continue to garner greater scrutiny, but even among this more particular analysis, they still acquire companies by the billions in a dangerous game of consolidation. It may not seem like an issue now, but things could quickly change when just a few companies control considerable capital.

References:

History of Monopolies

Recent Market Cap Information – 8 Market Cap

Acquisition of Activision Blizzard – Microsoft News

Biggest Mergers of the 2010s – Mirror Review